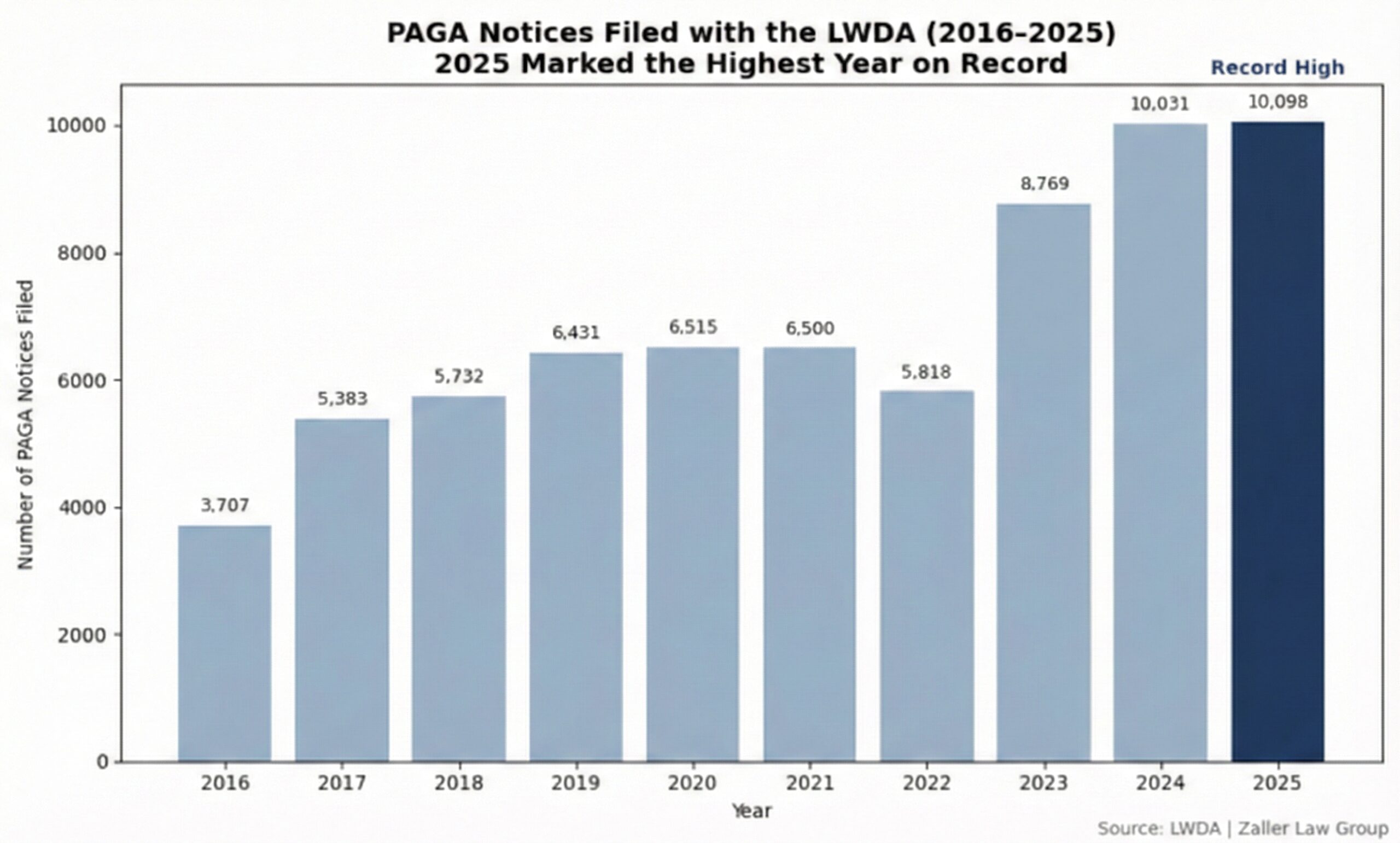

As California employers enter 2026, one thing is clear: PAGA risk is not going away—and it is not plateauing.

The numbers tell the story. Despite the highly publicized 2024 PAGA reforms, 2025 became the largest year yet for PAGA filings. That reality should reset expectations for California employers. Reform did not reduce filings—it changed how employers must defend them.

The new dividing line is no longer simply whether a violation occurred.

It is whether the employer can prove it took “all reasonable steps” to comply.

The 2026 Reality: PAGA Reform Rewards Preparation, Not Intent

The reformed PAGA statute gives employers something they never truly had before: meaningful penalty reduction for demonstrated compliance efforts.

- Employers that took reasonable steps before receiving a PAGA notice may cap penalties at 15%.

- Employers that take reasonable steps within 60 days after receiving a notice may cap penalties at 30%.

But these caps are not automatic. Courts evaluate reasonableness under the totality of the circumstances, considering:

- employer size and resources,

- the nature, severity, and duration of the alleged violations, and

- whether systems existed to prevent, detect, and correct issues.

Critically, the statute also recognizes that violations can occur even when reasonable steps are taken. That language matters—but only if employers can prove those steps with evidence.

“Reasonable Steps” Is Not a Checkbox—It’s an Evidence Standard

The statute makes clear that courts must evaluate reasonableness based on the totality of the circumstances, including:

- the size and resources of the employer,

- the nature, severity, and duration of the alleged violations, and

- whether the employer made good-faith efforts to comply.

Importantly, the law also states that the mere existence of a violation does not mean the employer failed to take reasonable steps. That language is critical. It recognizes that even compliant employers can experience errors—and shifts the focus to whether the employer had systems in place to prevent, detect, and correct problems.

What “Reasonable Steps” Must Look Like in 2026

As we start 2026, employers should think of reasonable steps as an operating system, not a compliance memo. Below is what that system should include.

1. Conduct Periodic Payroll and Wage-Hour Audits—and Act on the Results

Audits alone are not enough. What matters is what the employer does after issues are identified.

Strong examples include:

- Regular wage-hour audits focused on high-risk areas such as meal and rest periods, off-the-clock work, time rounding, regular rate calculations, premiums, and expense reimbursements.

- Exception reporting that flags patterns (missed meals, late meal breaks, frequent time edits) before they become systemic.

- A documented remediation process showing when issues were found, how they were corrected, and how recurrence was prevented.

From a PAGA perspective, an audit without documented corrective action is weak evidence. An audit paired with a remediation trail is powerful.

2. Maintain Lawful, Up-to-Date Written Policies—and Actually Use Them

Written policies matter, but only if they are current, distributed, and aligned with how the business operates.

Reasonable steps include:

- Wage-hour policies that clearly address timekeeping, meal and rest periods, premium pay, time edits, off-the-clock prohibitions, and reimbursements.

- Version control showing when policies were updated and why.

- Proof of dissemination—signed acknowledgments or digital confirmations.

- Integration of policies into onboarding and manager guidance, not just an employee handbook that sits on a shelf.

Courts and agencies look skeptically at policies that exist on paper but are ignored in practice.

3. Train Supervisors on Wage-Hour Compliance

Many PAGA claims are driven by front-line management behavior, not by payroll or back office managers. Training supervisors is a core component of the reasonable-steps analysis.

Effective training includes:

- Role-specific instruction for managers who schedule employees, approve time, or make payroll adjustments.

- Training on meal and rest period timing, time edits, off-the-clock risks, and premium pay.

- Documentation of attendance, materials used, and follow-up training when issues arise.

Training that is documented and refreshed over time carries significantly more weight than a one-time presentation years earlier.

4. Take Corrective Action When Supervisors Cause Violations

Reasonable steps also require accountability.

When audits, complaints, or data show that supervisors are contributing to violations, employers should be able to show:

- Coaching and retraining efforts,

- Escalating discipline where appropriate,

- Removal or limitation of time-edit authority for repeat offenders, and

- Compliance metrics built into management performance expectations.

This is often decisive in countering claims that violations are “systemic” or “intentional.”

5. Respond Strategically Within 60 Days of a PAGA Notice

For employers who did not already have these systems in place, the reform still provides an opportunity. Employers who take reasonable steps within 60 days after receiving a PAGA notice may still qualify for a reduced penalty cap.

A disciplined 60-day response typically includes:

- Immediate preservation and review of records tied to the alleged violations,

- A focused audit of affected locations, job classifications, and time periods,

- Prompt correction of payroll or scheduling practices,

- Targeted policy updates and supervisor retraining, and

- A clean documentation package showing what changed and when.

This window is short—and preparation before a notice is received dramatically improves outcomes.

The Takeaway for California Employers

The 2024 PAGA reforms reward employers who invest in process, documentation, and accountability. The question is no longer simply whether a violation occurred. It is whether the employer can show it acted reasonably before and after issues arose.

Employers who build their compliance systems now will be in a far stronger position when—not if—a PAGA notice arrives.

At Zaller Law Group, we help California employers build and document PAGA-ready compliance systems designed to meet the “reasonable steps” standard. If you want to reduce PAGA exposure and take advantage of the new penalty caps, now is the time to act.