What “Reasonable Steps” Really Mean in 2026: How California Employers Reduce PAGA and Employment Litigation Exposure

As California employers move through 2026, one thing is clear: employment litigation—and PAGA litigation in particular—is not slowing down.

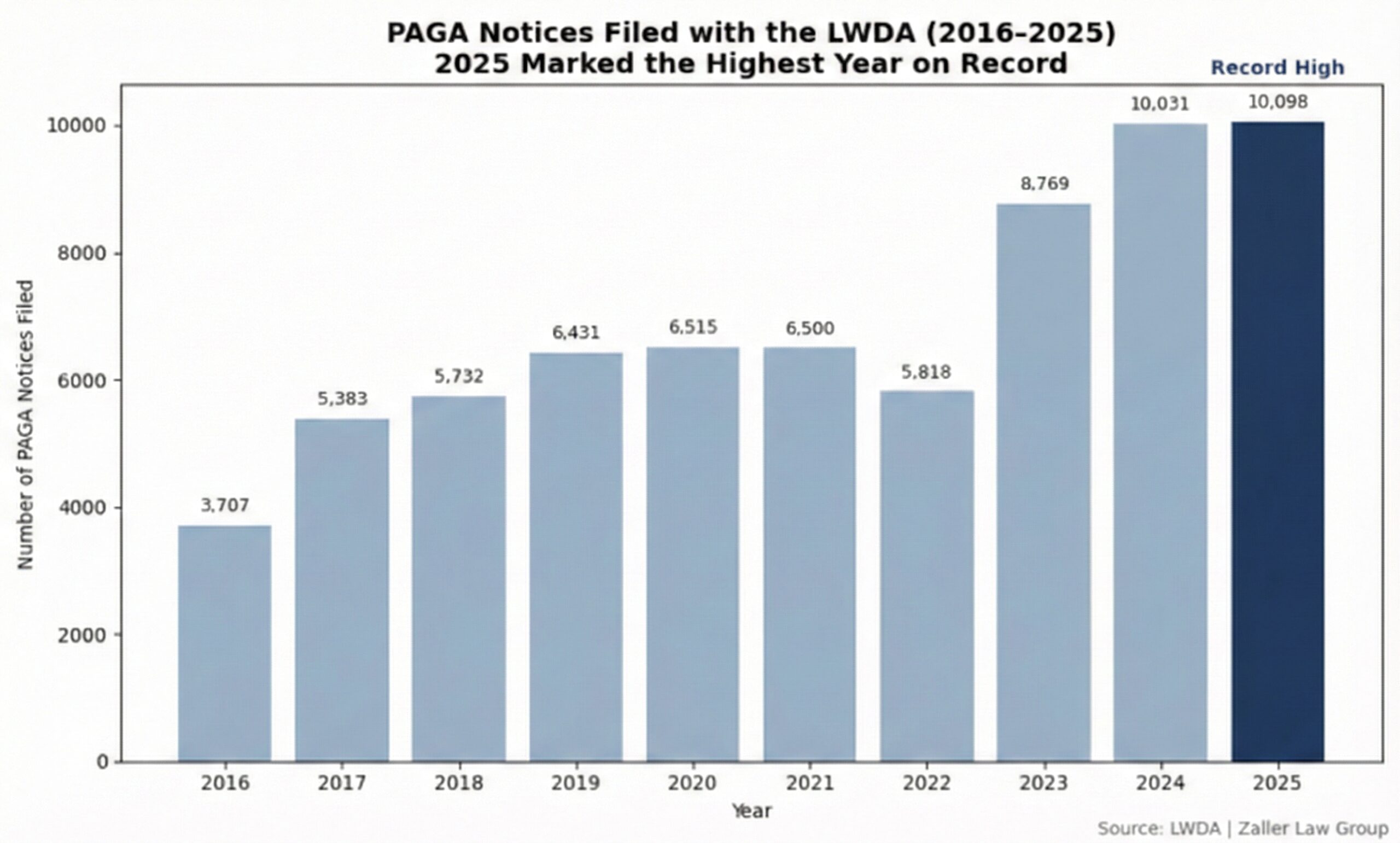

Despite the highly publicized 2024 PAGA reforms, 2025 became the largest year yet for PAGA LWDA filings. That reality has