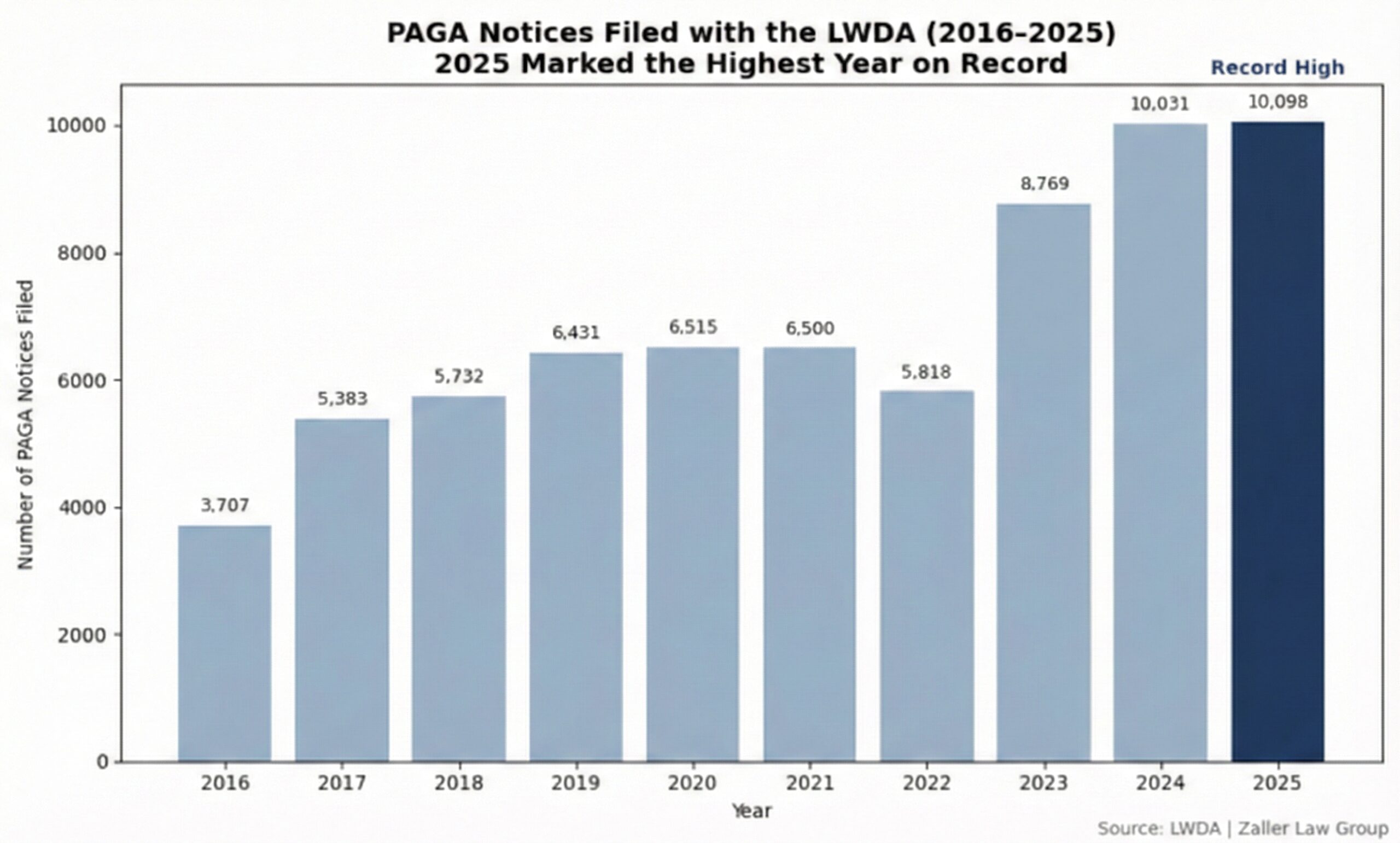

As California employers enter 2026, one thing is clear: PAGA risk is not going away—and it is not plateauing.

The numbers tell the story. Despite the highly publicized 2024 PAGA reforms, 2025 became the largest year yet for PAGA filings. That reality should reset expectations for California employers. Reform did not reduce filings—it changed how