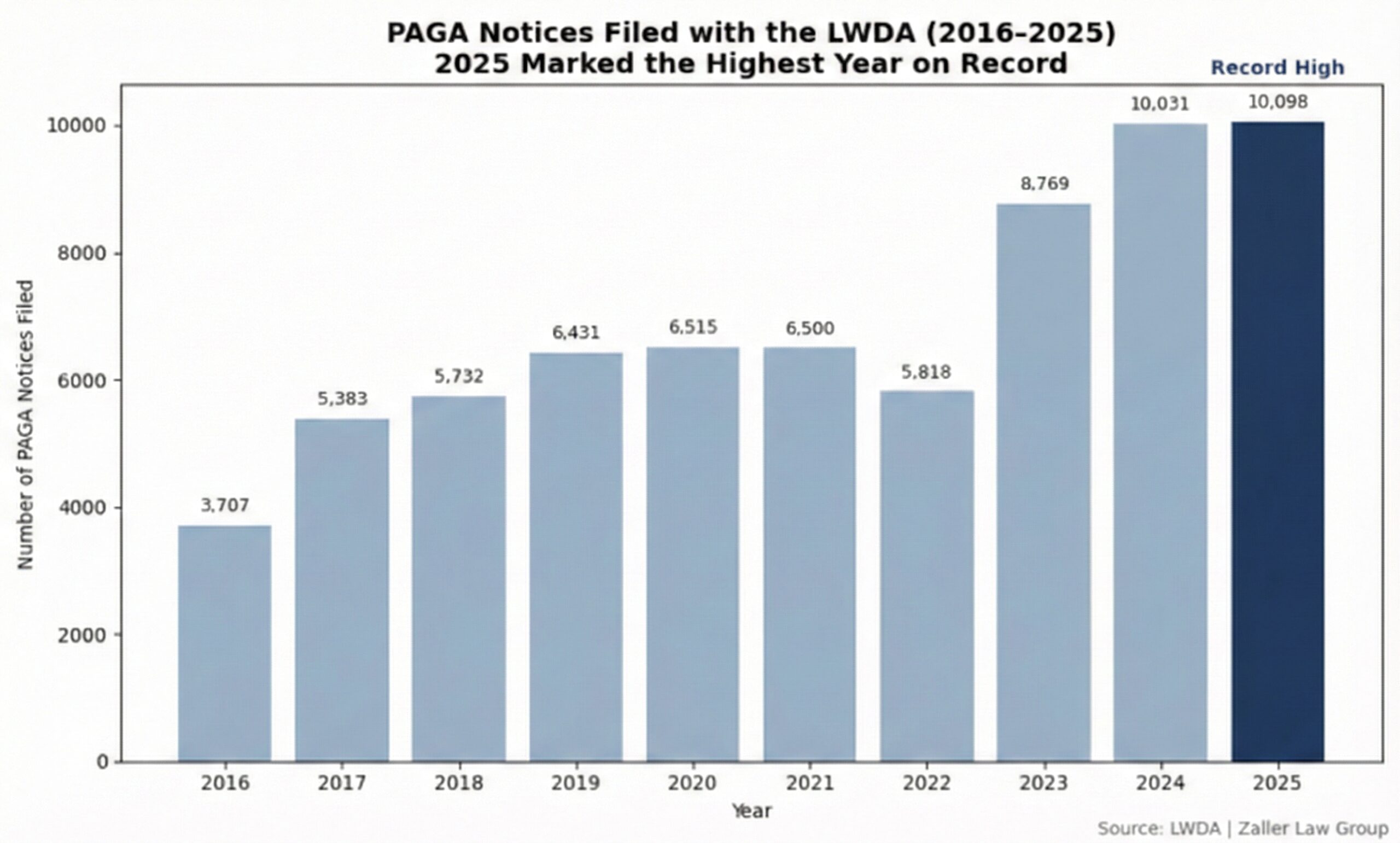

As California employers enter 2026, employment law compliance is no longer just about having policies in place—it is about being able to prove that the company took documented, reasonable steps to comply with the Labor Code before problems arose. Despite the 2024 PAGA reforms, PAGA filings continued to rise through 2025, and courts are now